How much am i able to borrow for a mortgage

61 2 9194 1700. Ad More Veterans Than Ever are Buying with 0 Down.

Mortgage Calculator How Much Can I Borrow Nerdwallet

Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate.

. The optimal amount for the best possible mortgage deal is 40 per cent. If you want a more accurate quote use our affordability calculator. They are established by the Federal Housing Finance Agency.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. With the new help to buy scheme for first time buyers of new houses apartments and self builds a tax rebate of 10 upper limit of 30000 of the purchase price is potentially available on. These days its usually capped at 45 times your annual income.

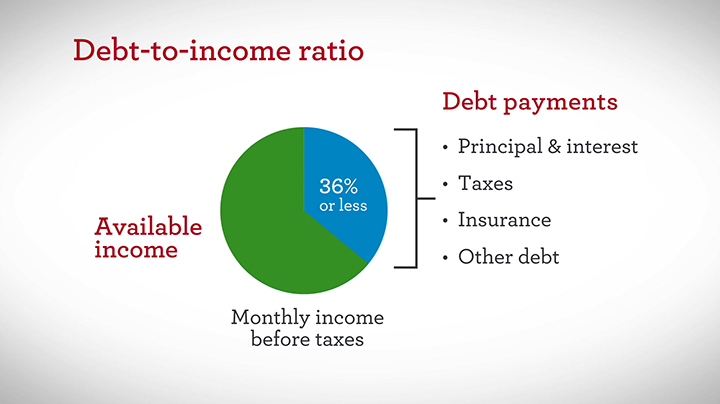

This ratio compares the amount you hope to borrow with how much the property is worth. For this reason our calculator uses your. As a general rule lenders want your mortgage payment to be less than 28 of your current gross income.

Ad Compare Mortgage Options Get Quotes. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. So if your lender is.

The possible disadvantages associated with a 15-year fixed rate mortgage are. In California they range from 424100 up to 636150. The sweet spot for getting a better mortgage deal is a 25 per cent deposit.

Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. 1 discount point equals 1 of your mortgage amount.

Check Eligibility for No Down Payment. But ultimately its down to the individual lender to decide. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today.

The more you put toward a down payment the lower your LTV ratio will be. If youre concerned about any of these talk to. Save Time Money.

As part of an. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Discount points are paid upfront when you close on your loan.

This includes hire purchases a. Find A Lender That Offers Great Service. Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

It looks like fixed rates are going up fast. I am now trying to find someone to. Its known as your loan-to-income ratio.

Ad Compare More Than Just Rates. So a discount point for a home that costs 340000 is equal to 3400. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Get a quick quote for how much you could borrow for a property youll live in based on your financial situation. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Trusted VA Home Loan Lender of 200000 Military Homebuyers.

The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Get Started Now With Quicken Loans.

Figure out how much mortgage you can afford. If your household income is 60000 annually you could likely borrow up to. Use Your Equity to Renovate Your Home Consolidate Debt Pay Education Expenses More.

The 30-year jumbo mortgage rate had a 52-week low of. Were not including additional liabilities in estimating the income. Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender.

Ad Compare the Best Mortgage Lenders Picked By Our Experts Get a Great Offer Apply Easily. Now lets say youre teaming up with someone else to get a joint mortgage thats. The maximum amount for high-cost areas is the same.

Were Americas 1 Online Lender. Theyll also look at your assets and. Check Eligibility for No Down Payment.

Its A Match Made In Heaven. Under this particular formula a person that is earning. That means that on your own you can probably borrow around 108000 24000 x 45 108000.

Trusted VA Home Loan Lender of 200000 Military Homebuyers. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Percentage of your income.

Looking For A Mortgage. Ad More Veterans Than Ever are Buying with 0 Down. How much you can afford to borrow depends on your deposit your income your credit history and the value of the property itself.

This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow. About this mortgage calculation. Ad Access Your Homes Equity With Our 399 12-Month Fixed Intro Rate¹ Line of Credit.

Find out how much you could borrow. A common rule of thumb is that between 30 and 40 of your total income should be going into any fixed repayments.

Great Information For You First Time Homebuyers Qualify For All Four Apply Here Loanfimortgage Com Understanding Mortgages Mortgage Bad Credit Mortgage

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Wondering How Much Home You Qualify For Interest Rates Have A Big Impact On Your Ability To Borrow Lea Fixed Rate Mortgage The Borrowers Real Estate Services

Understand The Total Cost Of Borrowing Wells Fargo

The Power Of Mortgage Pre Approval Infographic Preapproved Mortgage Mortgage Mortgage Loans

Buying A House Estimate How Much You May Be Able To Borrow With Today S Mortgage Rates And Refinance Rates Use Our Wells Fargo Mortgage Rate And Paymen Natural

Guarantor Home Loans Borrow 105 Home Loans The Borrowers Home Buying

Mortgage Calculator How Much Can I Borrow Nerdwallet

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Mortgage Calculator How Much Can I Borrow Nerdwallet

Pin On Data Vis

Pin On Ui Design

Mortgage How Much Can You Borrow Wells Fargo

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

Your Home Loan Is A Combination Of Principal Interest Taxes And Insurance The Principal Of The Loan Is The Initial Am Borrow Money The Borrowers Home Loans

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning