50+ can i use rental income to qualify for a mortgage

In fact you can use that expected income for an. Choose The Loan That Suits You.

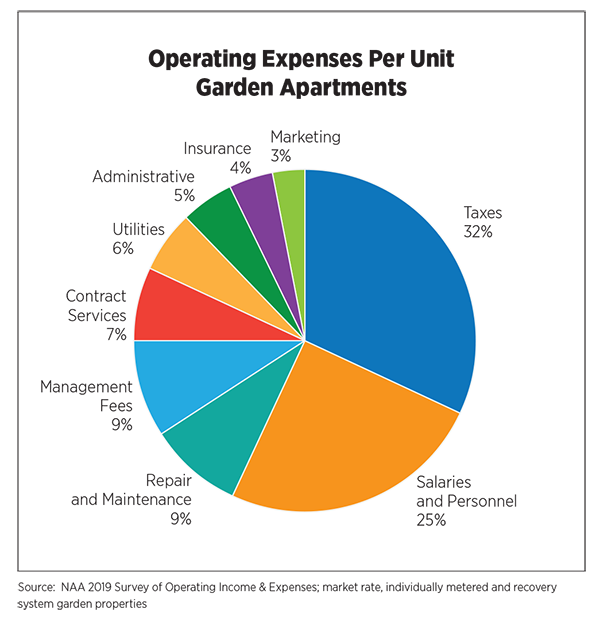

2019 Naa Survey Of Operating Income Expenses In Rental Apartment Communities National Apartment Association

Web With numerous lenders on hand.

. Web Web Yes you can use the expected rental income to offset the monthly mortgage payment of the property you are buying. Web Can You Use Rental Income To Qualify For A Mortgage Yes. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Get Instantly Matched With Your Ideal Mortgage Lender. Use NerdWallet Reviews To Research Lenders. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes.

Ad Explore Home Loan Options with the Army National Guard Today. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes. Take Advantage And Lock In A Great Rate.

Compare Now Find The Lowest Rate. Dont Settle Save By Choosing The Lowest Rate. Web Under the new rules which go into effect September 28 2015 the CMHC says it will allow 100 of rental suite income when qualifying for a mortgage of a two-unit owner.

Calculate and See How Much You Can Afford. Ad Get All The Info You Need To Choose a Mortgage Loan. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Web With numerous lenders on hand you can apply and demonstrate your accounts for at least the previous three years using rental income to qualify for a. Web VA loans will count 75 of future rental income but you must be able to prove that you have experience renting properties or are otherwise likely to succeed as a. Web If you also rent a room in your home for 700 a month your lender will now consider your gross monthly income to be 5700.

Compare Now Find The Lowest Rate. Web Eligible rents on the subject property gross monthly rent must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties. Ad Easier Qualification And Low Rates With Government Backed Security.

Web Can you use rental income to qualify for a residential mortgage. Most of the time you can factor in 75 of your potential monthly income. Get Instantly Matched With Your Ideal Mortgage Lender.

Web RentReporters tracks your rent payments by contacting your landlord directly to verify that on-time payment has been made. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web You can use rental income to qualify for several loan programs.

Lock In Your Low Rate Today. Ad Find Out If You Qualify For a Low Rate in Minutes. Web Yes you can.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Although not all mortgage lenders will approve a mortgage solely on the basis of rental income. Your mortgage advisor will order an appraisal and you can count 75 of the.

But with a bi-weekly. Web While some borrowers can use future rental income to qualify for a mortgage its not as simple as including the total amount collected each month as income. Join the Army National Guard and Find Home Loan Benefits that Suit You.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Whether the property is owner occupied or non-owner occupied subject to a mortgage loan insurance MLI application or not CMHC offers different approaches to. You can get an estimate of your debt.

Compare Apply Directly Online. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. With this extra monthly income you.

A conventional loan An FHA loan Or a VA loan but only on a 2-4 unit multi-family. Compare Apply Directly Online. The sign-up fee is 9495 which will get.

Lock Rates For 90 Days While You Research. Web Your ideal DTI to qualify for a rental property mortgage is usually between 36 and 45. Use our DTI calculator to see if youre in the right range.

Yes if youre a professional landlord most lenders do accept the income you receive from your. Web Your debt-to-income ratio helps determine if you would qualify for a mortgage. Web Yes you can use the expected rental income to offset the monthly mortgage payment of the property you are buying.

Web But you can still use potential rental income toward your qualifying income.

I Want To Rent A Home In Howard County Howard County

Guide To Buying A Home In New Brunswick New Brunswick Financial And Consumer Services Commission Fcnb

How To Buy Your First Rental Property Rentprep

What How When To Communicate With Guests

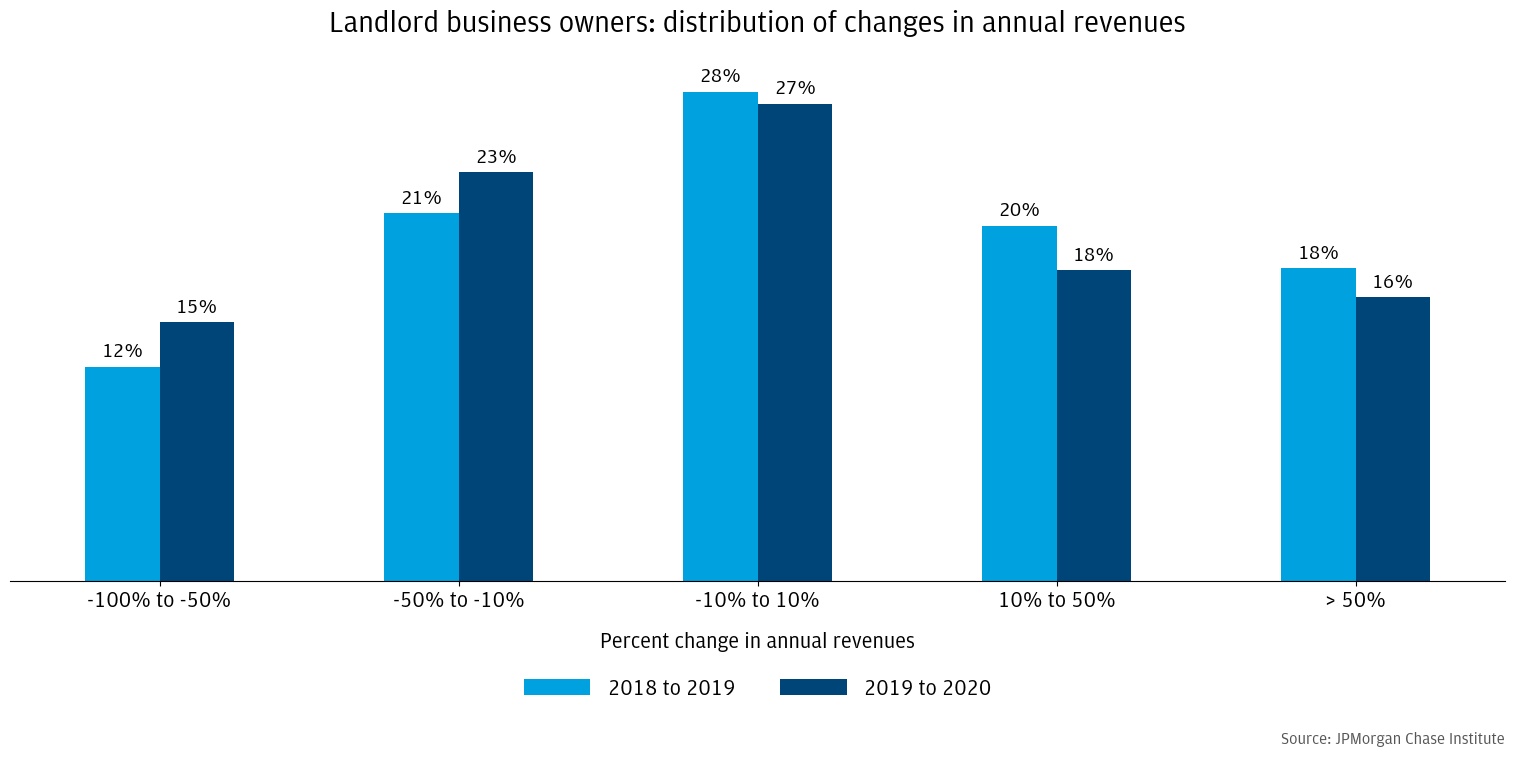

How Did Landlords Fare During Covid

How To Furnish Rental Property A Guide For Landlords

What To Know About Reverse Mortgages

Using Rental Income To Qualify For A Mortgage What You Need To Know

Using Rental Income To Qualify For A Mortgage What You Need To Know

How To Buy A House 50 Tips Moneysavingexpert

Top 12 Best Hotel Channel Managers 2022 Comparison Hotelfriend

Tax Minimisation Strategies For High Income Earners

Top 50 Machine Learning Projects Ideas For Beginners In 2023

Mortgages For Seniors Should You Get A Home Loan In Retirement Bankrate

Covid 19 Coronavirus Response Summit Nj

Can You Use Rental Income To Qualify For A Mortgage

Using Future Rental Income To Qualify For Mortgage